YOUR TAX AND FINANCIAL HEALTH PARTNER

JOIN THOUSANDS OF SAVVY INDIVIDUALS AND BUSINESSES WHO HAVE CHOSEN HOOD PROFESSIONALS TO ENSURE THEY KEEP MORE, SAVE MORE AND PROTECT MORE.

get started

Empowering your financial wellness every step of the way, is not just what we do – it’s who we are.

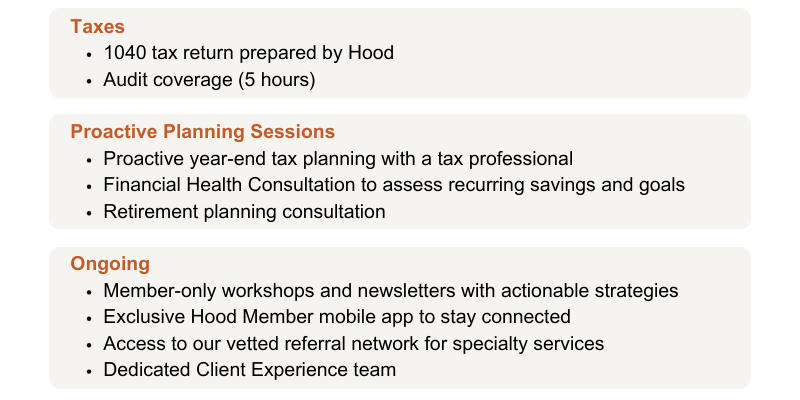

We offer a 12-month membership for tax and financial health planning. We not only take care of your taxes but become your financial wellness partner year round, so you have the support and guidance when you need it.

One fixed price. No surprises. No more hourly rates.

Our membership is designed to give you confidence and peace of mind when it comes to your money matters.

contact uS

“I’ve had my taxes done by Hood & Associates for many years now and they have always done an amazing job! Everyone has always been so polite and courteous and they treat me like family. The location is amazing and easy to find, I highly recommend working with Hood & Associates CPAs!”

–Evan Martin

Subscribe to Our Newsletter

Hood & Associates – Paul Hood, CPA

1821 SE Washington Blvd, Bartlesville, OK 74006

(918)- 336-7600

As Seen In